Risk Management

Adhering to the risk management philosophy of “comprehensive risk management and prudence create values”, the Company takes risk management as one of the core contents of its operation and business activities, and has established a set of effective comprehensive risk management systems covering risk system, organization, system, indicators, personnel and culture. We have also actively constructed a risk management system for new businesses to support the development of innovative businesses.

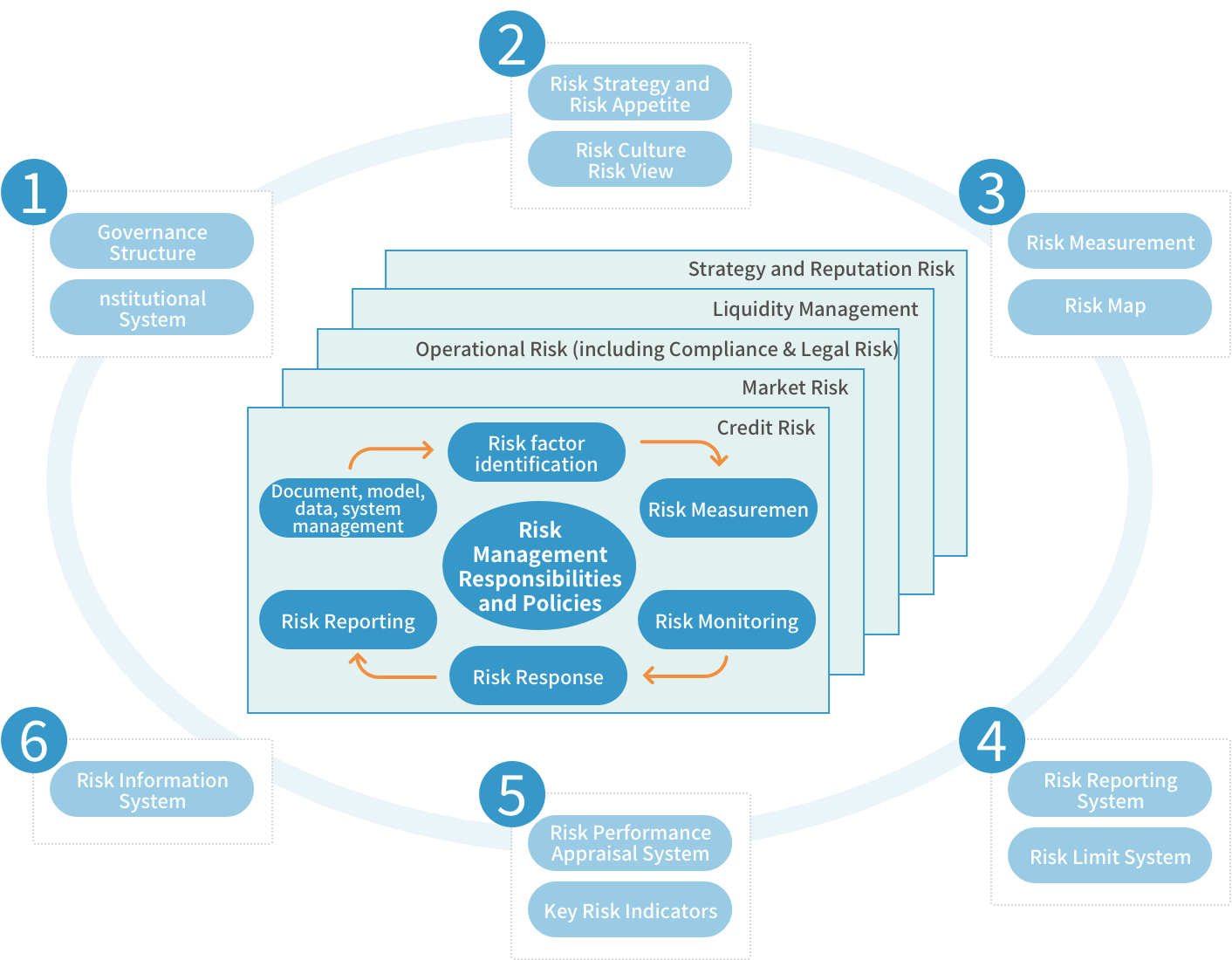

“5+1” Risk Management System

Taking “system, system and product” as the mainstay, the Company continues to improve its comprehensive risk management system, and has established a “5+1” risk governance system covering risk governance structure, strategy and preference, risk measurement, risk reporting, performance assessment and information system, which has contributed to the sound development of its business.

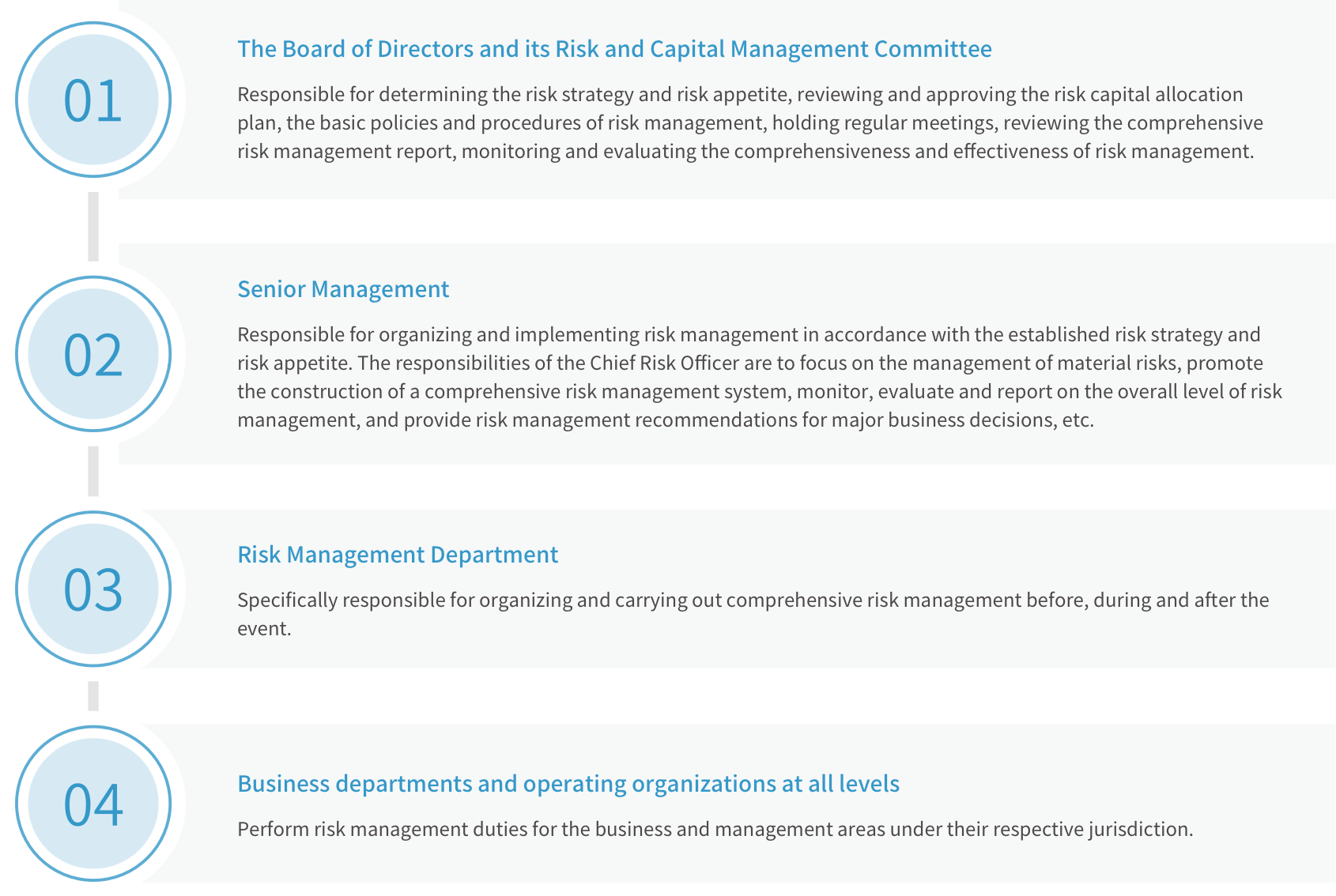

(1) Risk governance structure

We will adhere to the financial fundamentals, take the responsibility of serving people's livelihood and the real economy, allocate more financial resources to the key areas and weak links of economic and social development, and better meet the diversified financial needs of the people and the real economy.

Three lines of defense

Four tiers

(2) Strategy and Preference

The Company adheres to the business philosophy of long-term and steady development, and formulates its risk appetite every year based on the market, strategy and actual situation, and implements it to each business line through specific breakdown of risk policy and risk limits. The risk policy strengthens risk guidelines from the dimensions of industry, region, customer and business (product), and strictly controls the market access.

(3) Risk Measurement

The Company has built a number of risk measurement modeling tools and continues to improve the accuracy of risk measurement. Based on the identification and assessment of business risks and with reference to the Basel Accord, the risk-adjusted return on capital (RAROC) is obtained by measuring various types of risks through appropriate models, which are used in various areas such as business access, risk pricing and performance appraisal.

(4) Risk Reporting

The risk reporting system covers two major types of regular reports and special reports to monitor and assess the risk situation in a timely manner, realizing information aggregation and analysis from the front-end of the business to the Group as a whole, and helping all levels of management to grasp the risk situation in a timely manner and have a clear understanding of the situation. Yuexiu Financial Holding sets annual limit indicators for various types of risks, such as strategic risk, credit risk, market risk, liquidity risk, operational risk, etc. Risk limits are broken down layer by layer from the Group level to each business and product line, and are continuously monitored, with the right to exceed the limits being suspended, so as to keep overall risks under control.

(5) Performance Assessment

Risk assessment indicators have covered all business subsidiaries, and have been decomposed and extended to business teams and individuals, while focusing on the promotion of relevant risk management through the inclusion of “battles that must be won”. The Company and its subsidiaries have formulated a system of accountability for risk events, so as to realize the principle of “accountability for responsibility and accountability for failure”.

(6) Information System

The Company has continued to promote risk management informationization construction to enhance its risk identification, early warning and detection, measurement and monitoring, risk management and control capabilities, and has put online a number of modules in the comprehensive risk management system, such as unified customer view, credit risk, liquidity risk, industry and regional ratings, basically realized strong control of the system in terms of risk policy, customer ratings, unified credit granting, and other functions, and has continued to iterate and optimize the functions of the risk management system.